tax payment forgiveness program

The IRS has the final say on whether you qualify for debt forgiveness. First-time penalty abatement is another one-time forgiveness program that allows the IRS to waive all fines and penalties you owe.

Irs Tax Payment Plans Installments Or Offer In Compromise

Allowing small businesses to make payments on tax debts up to 25000.

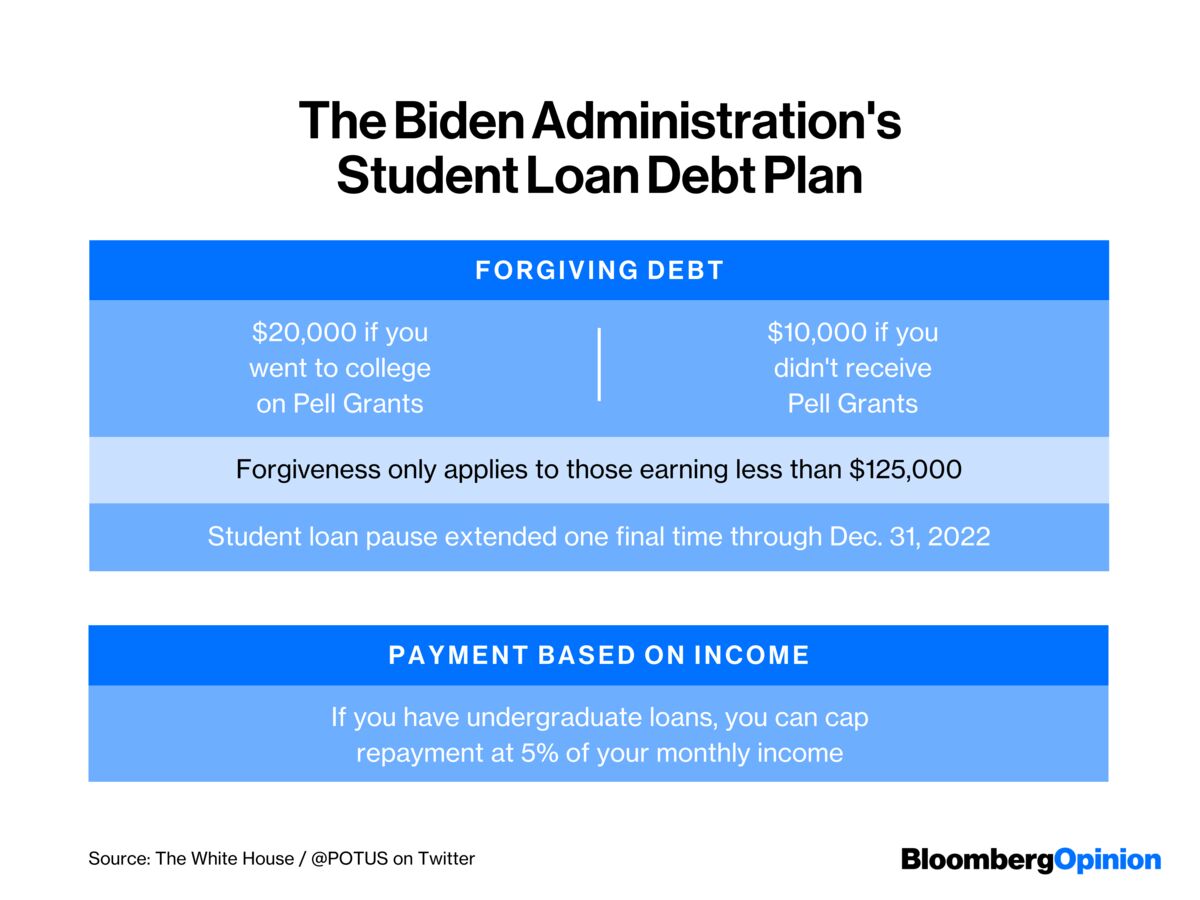

. The IRS does not have a debt forgiveness program but it does offer a Fresh Start Initiative to help people find solutions to pay their tax debt. Under Bidens one-time student loan cancellation initiative announced in August borrowers with government-held federal student loans can receive up to 20000 in student. Removing tax liens once payments are made on an eligible installment plan.

An offer in compromise allows you to settle your tax debt for less than the full amount you owe. Many people are struggling to pay their taxes this is a simple fact of life. In general though the agency looks for taxpayers who.

Student Loan Forgiveness and Your Taxes. A total tax debt balance of 50000 or below. The IRS Fresh Start Program allows for tax forgiveness credits against your earned income to help reduce the overall amount of money you owe in taxes every year.

Governor Newsom Calls for Early Action to Waive Taxes on Forgiven Student Loan Debt Providing Up to 13 Billion in Relief to 35 Million Borrowers Published. Latest Updates on Coronavirus Tax Relief Penalty relief for certain 2019 and 2020 returns. Some of the biggest perks include.

The IRS debt forgiveness program is an initiative created by Internal Revenue Services to facilitate payments and provide tools and assistance to taxpayers who owe money. To help struggling taxpayers affected by the COVID-19 pandemic the IRS issued Notice 2022-36 PDF. Raises the amount of whats considered non-discretionary income.

The Mayors Office and Department of Finance is offering a late fee forgiveness or amnesty program for residents to take advantage of from October 1 until December 31 2022. The IRS generally looks at three factors to see if someone qualifies for debt forgiveness. Doubling the offer in.

No tax debts for the. WASHINGTON Associate Justice Amy Coney Barrett on Friday denied a second challenge to President Joe Bidens student loan forgiveness. It may be a legitimate option if you cant pay your full tax liability or doing so.

The qualification requirements are. As a general rule any kind of debt thats forgiven or reduced by the governmentincluding student loan debtis considered taxable. The IRS debt forgiveness program is a way for taxpayers who owe money to the IRS to repay their debts in a more manageable way.

If you owe a substantial amount of. If you pursue certain payment. The program offers tools and assistance to.

That is why the IRS introduced several means of tax relief services one of which is the IRS Debt Forgiveness. First the total tax debt balance must be equal to or less than 50000. John Fritze USA TODAY 17 hrs ago.

Allows you to pay no more than 5 of your discretionary income monthly on undergraduate loans. One IRS tax forgiveness program also known as an offer in compromise comes with a long list of benefits.

Irs Tax Debt Relief The Complete Supermoney Library Supermoney

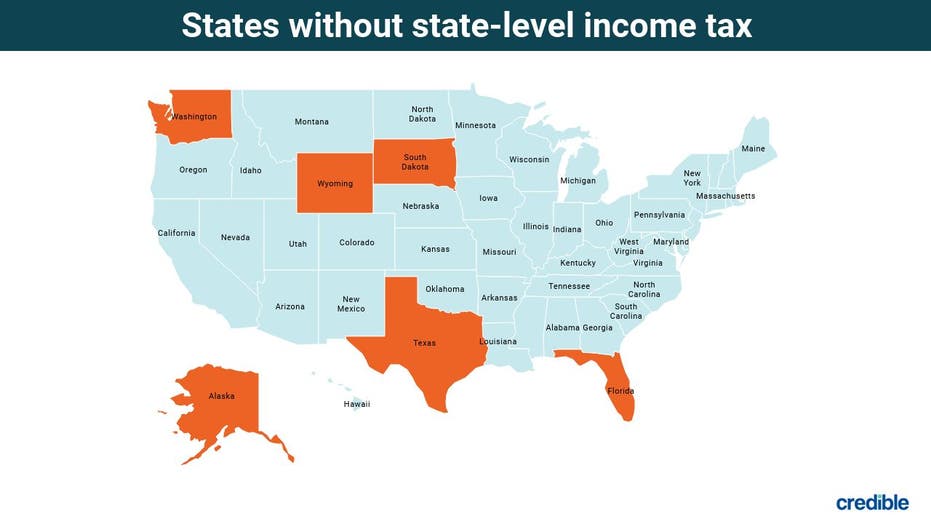

Which States Tax Student Loan Forgiveness And Why Is It So Complicated Tax Policy Center

If You Have Tax Debt Here Are 5 Tips To Set Things Right With The Irs

Do You Qualify For Irs Debt Forgiveness Check Now

Will Louisiana End Personal Income Taxes Soon It S Complicated Wwltv Com

Does The Irs Offer One Time Forgiveness Tax Debt Advisors

Irs Debt Forgiveness Program Are You Eligible Tax Relief Center

Irs Debt Forgiveness Program Tax Group Center

Will You Owe Taxes If Your Student Loan Is Forgiven Forbes Advisor Forbes Advisor

Federal Student Loan Forgiveness Your Questions Answered Best Colleges U S News

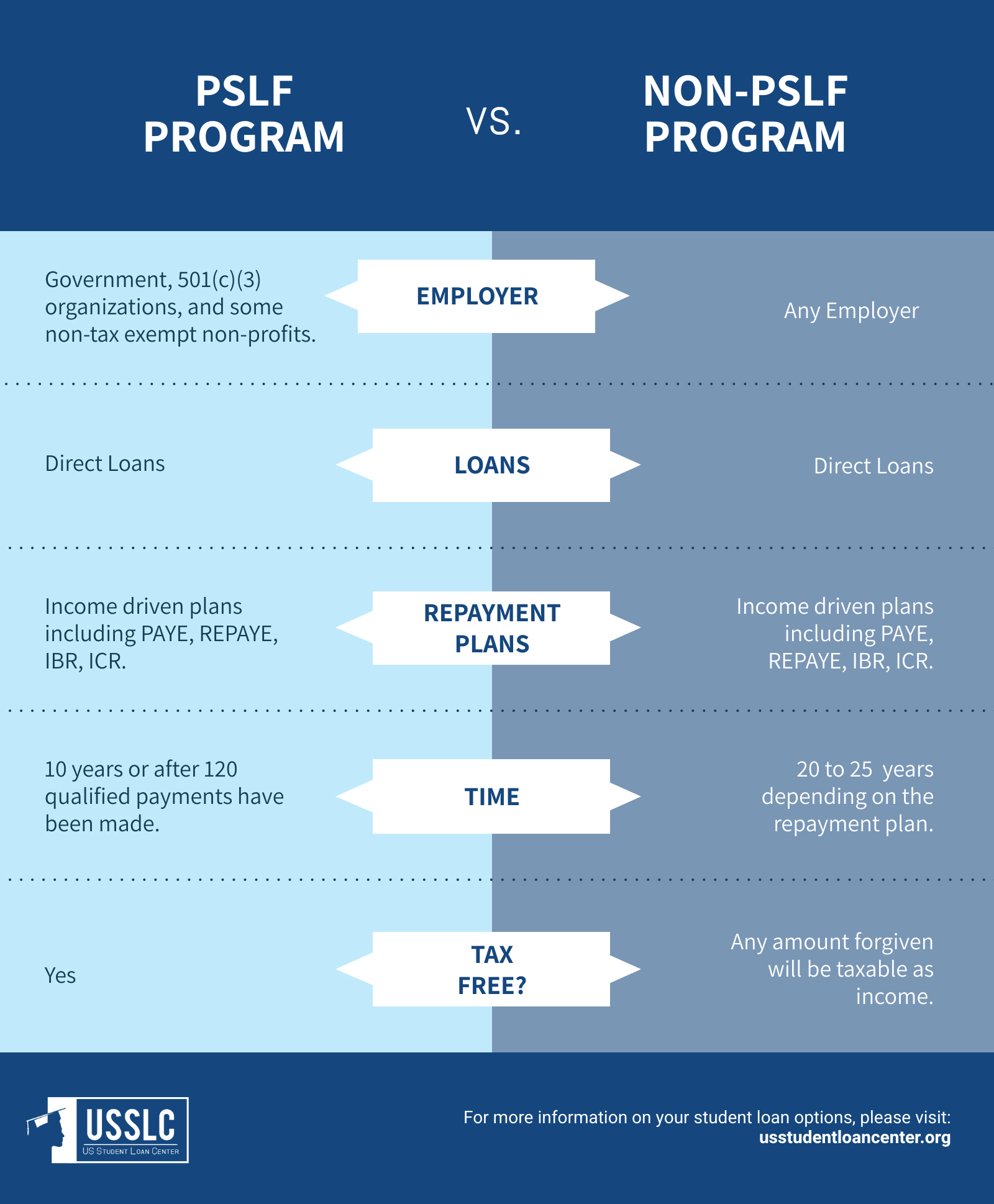

Public Service Loan Forgiveness Program

What S The Plan Student Loan Forgiveness

The Irs Tax Debt Forgiveness Program Explained

Student Loan Forgiveness Biden Plan To Cancel Debt Is A Costly Mistake Bloomberg

Will Your 10k 20k Of Student Loan Forgiveness Come With A Tax Hit Fox Business

Student Loan Forgiveness Forms Student Loan Planner

Tax Debt Relief Resolve Your Debt With The Irs Bankrate

2020 Guide To The Best Federal Student Loan Forgiveness Programs Fsld